-

Census 2021 Data

Census 2021 Data -

Homes & Property

Homes & Property -

Law and Order

Law and Order -

Jobs & Economy

Jobs & Economy -

Learning & Schools

Learning & Schools -

Essential Services

Essential Services -

Travel & Transport

Travel & Transport -

Local Amenities

Local Amenities -

Leisure & Recreation

Leisure & Recreation -

Environment

Environment

Yield

Swallow Croft, Leek, Staffordshire Moorlands, Staffordshire

ST13 8JB Staffordshire Moorlands District

This section gives the estimated property yield for the postcode based on our own unique algorithms, comparing it to the national average. We analyse gigabytes of data to explore why yields might be higher, lower, or in line with expectations. From local market trends to demand and property types, the data paints a clear picture of investment potential in ST13 8JB.

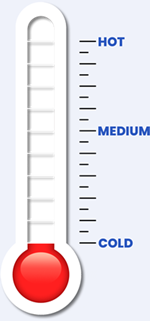

Estimated yield for property investors

2.9%

Yield

The estimated yield for the ST13 8JB postcode area is 2.9%, which is lower than the national average yield of 3.8%.

Summary

Low yields combined with moderate safety levels in ST13 8JB suggest that this area may not be the best choice for property investors looking for strong returns. It may be worth exploring other areas with higher yield potential.

Property yields in ST13 8JB are lower than average, which might reflect a more mature or stable market where opportunities for high returns are limited.

The combination of lower yields and higher levels of crime might indicate that the area is significantly less desirable for high-return investments due to its lack of safety. However, it could still appeal to those seeking stable, long-term growth.

The urban nature of ST13 8JB suggests that the area is well-connected and densely populated, which typically correlates with strong rental demand and potentially higher yields.

The high rate of home ownership indicates a stable community, which could limit the number of rental properties available, potentially driving up rental prices and yields for the properties that are rented out.

Despite the urban appeal, a lower safety score might deter some potential tenants, which could impact rental demand and yield stability.

Factors affecting yield in ST13 8JB

Understanding property yield involves considering various factors like affordability, income, and crime rates. These elements influence rental demand, property values, and ultimately, the return on investment.

Property Yield (%)

This is the rate of return on a property investment, expressed as a percentage of its value. Higher yields in ST13 8JB generally point to better investment potential, influenced by rent prices and local demand.

Property Affordability

This metric indicates the affordability of properties compared to the average income. Areas with less affordable housing often see higher rents, which could enhance yields but may also reduce buyer interest, impacting property appreciation.

Rental Affordability

Rental affordability examines the income proportion spent on rent. When rents are high compared to income, it can limit tenant interest and yield. Conversely, affordable rent levels may attract and retain tenants, supporting yield consistency.

Household Income

When household income is higher, tenants can typically pay more in rent, potentially improving yields. Yet, in wealthier areas, elevated property prices might reduce the yield percentage even with robust rental income.

Urban Location

Urban locations tend to offer higher yields driven by rental demand, particularly in cities popular with a young, mobile workforce. However, the elevated property prices in these areas can diminish the yield percentage despite strong rental income.

Employment Score

When unemployment is high, it often reflects economic instability, leading to lower rental demand and higher vacancy rates, which can decrease yield. Conversely, high employment rates suggests economic stability, boosting rental demand and improving yields.

Outright Ownership

Outright home ownership often reflects a settled, stable community with lower rental demand, which could lead to reduced yields. On the other hand, areas with fewer outright owners may have higher rental demand, which could enhance yields.

Crime & Safety Levels

High crime rates often lead to a decrease in renter interest and property values, resulting in lower yields. On the other hand, low crime rates make areas more appealing, which can enhance rental income, property values, and yields.

Best Performing Yields

The following postcodes within the ST13 location current have the highest performing yields:

Methodology

Our property yield estimates are derived from a custom algorithm built by PostcodeArea that combines data from the Census 2021 and other reliable third-party sources.

This algorithm evaluates several key factors - including affordability, rental affordability, household income, urbanisation, unemployment rates, property ownership levels, and safety. We do this by assigning weighted scores to each factor. These factors are chosen for their relevance to property investment, with the yield percentage itself carrying the most weight due to its direct impact on potential returns.

The algorithm also incorporates conditional logic to assess how different combinations of these factors might influence property yield. For example, a neighbourhood with high rental affordability and strong income levels might indicate robust rental demand, leading to higher yields.

Conversely, areas with high unemployment and low income could see reduced rental demand, potentially lowering yields.

By considering these interactions, the algorithm provides a more nuanced estimate than simple averages or single-factor analyses.

It's important to note that these yield figures are general estimates intended as a guide rather than precise calculations. While the algorithm offers valuable insights based on historical and statistical data, it may not fully capture the unique aspects of each neighbourhood or current market conditions.

Investors should use this information as a starting point for further analysis and consider it alongside other factors such as market trends and personal financial goals.