-

Census 2021 Data

Census 2021 Data -

Homes & Property

Homes & Property -

Law and Order

Law and Order -

Jobs & Economy

Jobs & Economy -

Learning & Schools

Learning & Schools -

Essential Services

Essential Services -

Travel & Transport

Travel & Transport -

Local Amenities

Local Amenities -

Leisure & Recreation

Leisure & Recreation -

Environment

Environment

Yield

Bannistre Mews, Tarleton, Preston, West Lancashire, Lancashire

PR4 6HW West Lancashire District (B)

This section gives the estimated property yield for the postcode based on our own unique algorithms, comparing it to the national average. We analyse gigabytes of data to explore why yields might be higher, lower, or in line with expectations. From local market trends to demand and property types, the data paints a clear picture of investment potential in PR4 6HW.

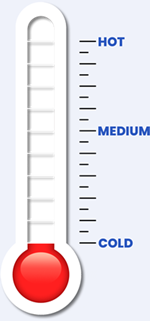

Estimated yield for property investors

2.6%

Yield

The estimated yield for the PR4 6HW postcode area is 2.6%, which is lower than the national average yield of 3.8%.

Summary

The PR4 6HW area has a lower yield, but its high safety score makes it a stable, if not lucrative, investment option - in the long term. Investors seeking long-term stability rather than high returns might find this area appealing.

Property yields in PR4 6HW are lower than average, which might reflect a more mature or stable market where opportunities for high returns are limited.

However, the high safety score adds value to the area, potentially attracting long-term tenants or buyers who prioritixe security, making it a stable investment option.

The less urban nature of PR4 6HW suggests a more suburban or rural setting, which could mean lower rental demand but potentially higher property values if the area is considered desirable for homebuyers.

The high ownership rate in this less urban area could indicate a strong preference for long-term residency, which might limit rental opportunities but could ensure more stable property values.

Factors affecting yield in PR4 6HW

Understanding property yield involves considering various factors like affordability, income, and crime rates. These elements influence rental demand, property values, and ultimately, the return on investment.

Property Yield (%)

This metric shows the income generated by a property, relative to its value. A higher yield can signal strong returns, depending on market rent levels and property pricing.

Property Affordability

Property affordability in PR4 6HW compares the cost of housing with average earnings. Lower affordability can lead to increased rents, potentially raising yields, but it might also dampen buyer enthusiasm, which could affect property values over time.

Rental Affordability

Rental affordability reflects the income percentage spent on rent. If rents are disproportionately high, it could deter tenants and reduce yield. Conversely, reasonable rent levels might encourage tenant retention, leading to more consistent yields.

Household Income

Greater household income often allows residents to pay higher rents, enhancing yield potential. But in affluent regions, the higher property prices could reduce the yield percentage, despite solid rental returns.

Urban Location

Urban areas tend to produce higher yields owing to strong demand from renters, especially in cities with a young and mobile workforce. However, the high property prices in such areas can reduce the overall yield percentage.

Employment Score

Economic instability, indicated by high unemployment, can reduce rental demand and increase vacancy rates, negatively affecting yield. A stable economy, reflected in high employment rates, typically results in higher rental demand and better yields.

Outright Ownership

Outright property ownership tends to reflect a stable community with lower rental demand, which can lead to lower yields. In areas with fewer outright owners, higher rental demand might drive better yields.

Crime & Safety Levels

High crime rates can deter renters, reduce property values, and lead to lower yields. Conversely, low crime rates make areas more attractive to renters and buyers, boosting both rental income and property value, which can enhance yield.

Best Performing Yields

The following postcodes within the PR4 location current have the highest performing yields:

Methodology

Our property yield estimates are derived from a custom algorithm built by PostcodeArea that combines data from the Census 2021 and other reliable third-party sources.

This algorithm evaluates several key factors - including affordability, rental affordability, household income, urbanisation, unemployment rates, property ownership levels, and safety. We do this by assigning weighted scores to each factor. These factors are chosen for their relevance to property investment, with the yield percentage itself carrying the most weight due to its direct impact on potential returns.

The algorithm also incorporates conditional logic to assess how different combinations of these factors might influence property yield. For example, a neighbourhood with high rental affordability and strong income levels might indicate robust rental demand, leading to higher yields.

Conversely, areas with high unemployment and low income could see reduced rental demand, potentially lowering yields.

By considering these interactions, the algorithm provides a more nuanced estimate than simple averages or single-factor analyses.

It's important to note that these yield figures are general estimates intended as a guide rather than precise calculations. While the algorithm offers valuable insights based on historical and statistical data, it may not fully capture the unique aspects of each neighbourhood or current market conditions.

Investors should use this information as a starting point for further analysis and consider it alongside other factors such as market trends and personal financial goals.